Is the reward worth the risk of collaborating with a flipper / developer to update an older home in an affluent neighborhood before selling?

The idea of transforming a million dollar home into a $3 million property — rather than selling it to someone else who will do just that — is worth exploring.

Partnering with a developer / flipper could be the answer. However, it is critical to take time and invest money to structure the arrangement to protect you, the homeowner, and understand exactly how that arrangement will work.

As I started pondering this idea, the fear starts swirling about what could go wrong! What if the builder disappears mid-project? What if labor and materials prices skyrocket mid-project? What if…what if?????

To figure out how this could work, I asked ChatGPT for some thoughts (with the intention of getting input from people who have done this, after). The results surprised me with how complete and common sense they were. I will keep this post updated / corrected with advice and stories from real East Bay developers and lawyers on how to make such a partnership work.

Structuring a partnership with a residential developer to update your house while sharing profits can be a great opportunity, but it requires careful legal and financial planning to protect yourself. Here’s how you can approach this situation to mitigate liability:

1. Use a Joint Venture Agreement

ChatGPT says: Create a detailed joint venture (JV) agreement between you and the developer. This contract outlines the terms of your partnership, including roles, responsibilities, financial contributions, timelines, and profit-sharing.

Susie’s thoughts: It’s important for the homeowner to be the one creating the joint venture agreement or at least hiring a lawyer to review it, if you’re basing the agreement on a past project the builder worked on. You want to make sure it is more in your favor that in the joint venture developers. After all, if the builder partner walks away, you don’t want to be held with a partially finished…or totally gutted house along with liens on the house…which leads to the next points.

2. Do NOT Immediately Add the Developer to the Deed

Chat GPT says: Adding the developer to your deed immediately transfers partial ownership and can expose you to unnecessary risk. Instead:

- Use a lien or contractual interest as security for the developer’s investment.

- Consider only transferring deed ownership at a specific milestone, like the sale of the property.

3. Include Completion Safeguards

ChatGPT says: To address the risk of the developer walking away mid-project:

- Require the developer to post a performance bond or completion guarantee, which provides funds to complete the project if the developer defaults.

- Retain control of construction funds in an escrow account, releasing payments only after specific project milestones are met.

- Define strict remedies in the agreement, like hiring a replacement contractor, at the developer’s expense, if they fail to meet their obligations.

4. Protect Against Unpaid Contractors (Mechanics’ Liens)

ChatGPT says: Mechanics’ liens could be placed on your property if the developer doesn’t pay subcontractors or suppliers. To prevent this:

- Require the developer to provide lien waivers for all payments made.

- Use an escrow or title company to manage payments to ensure all contractors are paid directly.

- Make sure the developer has adequate insurance and is in compliance with all licensing requirements.

5. Have Insurance and Indemnity

- Ensure the developer carries a series of liability policies:

- general liability insurance

- workers’ compensation, and

- a builder’s risk policy to cover damages or injuries during construction.

- Include an indemnification clause requiring the developer to hold you harmless for any legal or financial issues arising from their actions.

6. Protect Your Equity in the Property

ChatGPT makes a few very important points to safeguard your financial interest:

- Retain majority ownership or a controlling interest in the property until the project is completed.

- Specify that you have priority in repayment from sale proceeds before profits are distributed.

7. Establish a Dispute Resolution Mechanism

In case conflicts arise, include clauses for mediation or arbitration to resolve disputes quickly and affordably without resorting to litigation.

8. Work with Professionals

This is a complex legal and financial arrangement. You need a team of experienced professionals, which will be an investment in your success:

- A real estate attorney to draft and review contracts.

- A tax advisor to understand the implications of profit-sharing and any changes to property ownership.

- A title / escrow company to ensure clear title management during and after construction. In California companies such as Chicago Title and ORTC and both handle the money for payments based on milestones as well as the title process.

By structuring the agreement carefully and ensuring safeguards are in place, you can protect yourself from liability while creating a beneficial partnership.

Is it worth the effort and expense to partner with a flipper to renovate your property before selling?

Good question.

Some homeowners might simply consider asking their REALTOR® to help them make essential updates such as flooring, paint, electrical, etc. Compass offers a loan program that can be re-paid from escrow. That approach is a lot faster than a major re-development. It also could potentially net the same as investing in a year-long project without all the complications and expenses.

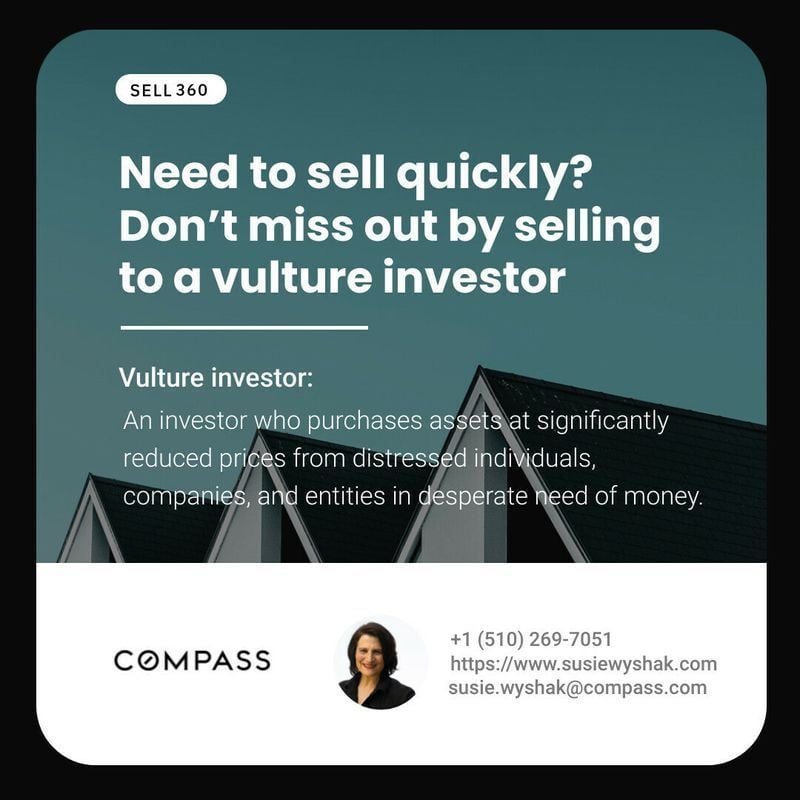

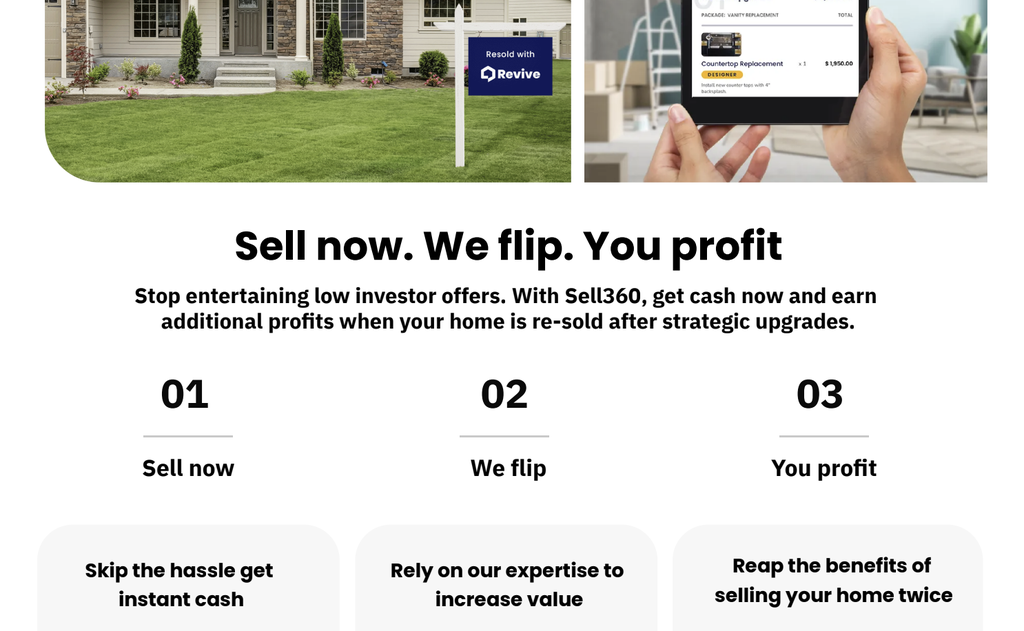

Another option is to ask your REALTOR® about partner with a company such as Revive. This company can help make updates (paid out of escrow) as do several other companies. Revive can also potentially buy a house outright, update it, and then share profits from the second sale with the original seller. (Unfortunately, at the moment, they don’t work with multi-family properties, even duplexes.)

If you’re sitting on a fixer in a city such as Piedmont, San Francisco or Lafayette, it might be worth exploring how to partner with a developer.

Here are just a few questions to help you (and me) decide what to do?

- What bottomline do you want to take away from your property sale and what would the expenses be to undertake a huge remodel? (These expenses might include the monthly mortgage, property tax, utilities, legal fees, closing / selling costs, and whatever else you negotiate — meanwhile you are living somewhere else.)

- What do you stand to gain by partnering with a flipper or developer for a major remodel vs. making a few cosmestic and functional updates to the house to increase appeal, then selling it in a few weeks / months rather than potentially a year?

- What is your risk tolerance to depend on a partner to stick to their end of the agreement?

- Are you prepared to be involved in this major project or step aside and monitor it from afar?

Be sure, if you do decide to partner with a developer or builder, that you know their reputation well, that they are licensed, have workers comp, will get permits, and are very well funded to undertake the remodel.

Full transparency and extensive planning is the key to success.

As mentioned earlier, an in-between solution might be to sell to a company such as Revive who can then update the house and share in the profits with the original homeowner, once the fixed-up house sells? (See the flyer about Revive 360.)

Have you remodeled a house to sell? Tell me about it so I can add it to the post, anonymously or with your info if you like.